はじめに

Amazon、eBay、 楽天、Shopify、WooCommerce、コロナ渦において世界で拡大し、今でやあらゆる企業が注目する「越境EC(E-commerce)」。越境ECはサイト作成後数分後から販売開始でき、世界の市場からの新たな売上機会になるといった良い面は紹介されます。反面、現地の税金や、様々なコストについてはあまり共有されていません。VATなど現地の税金は、販売者が現地の購入者に課税・徴収しますが、越境ECの場合でも課税・徴収・申告の場合は発生します。

税理士や弁護士等、国内の専門家が海外の税務や法務の知見が有る訳ではありません。

このコラムでは、越境ECの税務面について、豊富な経験を有するオプティ株式会社が「越境EC税務ナビ」としてQ&A形式で提供します。当越境EC税務ナビが、越境ECを考えている様々な企業のお役立ちになれば幸いです。

【Q】Amazon FBA販売を行い、EUに向けて販売します。この場合、どの国でVAT登録及びVAT申告をしたら宜しいでしょうか。

【A】最低でもFBA所在地国でのVAT登録・VAT申告は必要です。

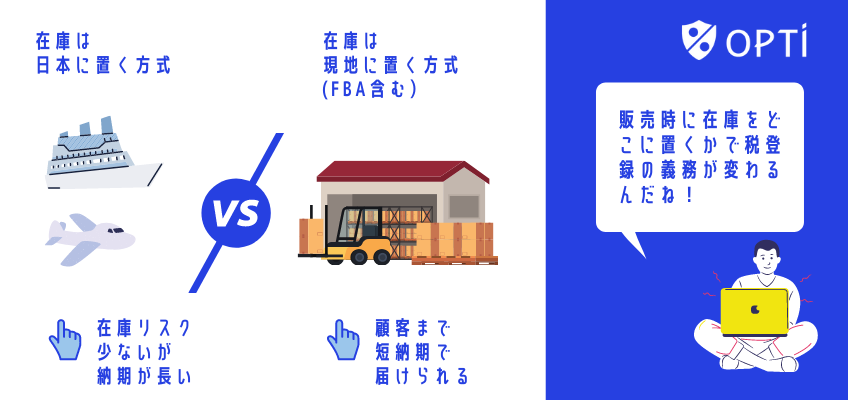

Amazon欧州などでの物品販売の際、FBAを利用する方法と日本から直接送付する方法と2週類あります。

その中で、FBAを利用する場合の税務について説明します。

フルフィルメント by Amazon (FBA) とは、Amazonが出品者に代わって注文を受け、商品を出荷するプログラムであり、 出品者は商品をAmazonフルフィルメントセンターに納品し、納品された商品をAmazon 配送センターにて保管し、カスタマーからの注文に応じて出荷する方法です。

FBAサービスの場合、FBA倉庫にて自社の在庫を保有している国にてVAT登録をしなくてはなりません。この理由として、倉庫地にて物品を輸入するからです。(尚、物品販売に関するVATに関しては、オンラインマーケットプレイスがVAT徴収する義務がありますので、Amazonの場合は売上に関するVAT申告義務はありません。)

免責事項

当コラムには一般的な情報のみが掲載されており、読者のみなさまご自身のリスクにおいてご使用いただくことを前提としています。また、情報の精度向上には努めておるものの不正確な情報を掲載することもあります。当コラムの読者のみなさまは、何らかの決定を下したり行動をとったりする前に、適切な資格を有する専門家にご相談いただく必要があり、当コラムを使用したことに起因する損失のリスクおよび責任は全て、当コラムの読者のみなさまご自身に負っていただくものです。

COMMENTS