MyOpti

One of the problems with registering for taxes overseas is that it is unclear who should do what and when. The same task management and document control issues arise with monthly, quarterly, and other tax filings. With 14 years of experience in international tax filing and handling numerous VAT registrations, we have developed our own service, MyOpti, to make it possible to keep these documents and forms and to visualize task management.

Customer issues we have seen in 14 years

Customer issues we have seen in 14 years

- We are proud to say that we have the highest number of VAT registrations and declarations in the country.

- The three main issues we have seen our clients face over the past 14 years are document storage, task management, and communication.

- We have developed a SaaS service that can manage all of these.

Development difficulties

Development difficulties

- We had to check the requirements in each country during development. To this end, we worked with more than 200 local firms that we have partnered with, one by one, to squash each problem.

- The challenge of creating a tax filing service for non-resident companies was twofold: researching local systems and developing IT. We are proud to say that the result is the best service we have ever developed.

Benefits to be gained

Benefits to be gained

- Simplified Communication

- Task management

- Retention of forms

- Storage of past tax returns

- Data upload

- Dashboard

MyOpti Features

MyOpti has a wide range of features for sole proprietors and small businesses alike.

File transfers can be uploaded for secure storage.

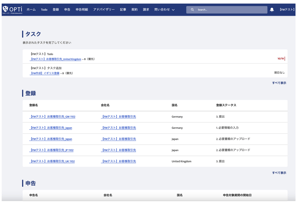

Actual screen

Visualize Tasks and Progress with MyOpti

Our MyOpti system has been developed specifically for VAT registration and VAT declaration for non-resident companies. This allows you to escape from email communication and email task management by legacy type offices.

Preparation for VAT refund

Since its inception, the company has issued a number of VAT refunds for the following expenses

Travel expenses

Vendor-to-vendor expenses

Import VAT

However, in the case of vendor-to-vendor expenses and import VAT, the availability of the refund system for non-resident companies depends on whether or not the taxable activity took place locally.

With our 14 years of experience and knowledge of the issues that Japanese companies face, we have the know-how to submit the documents that will be adopted by a high percentage of applicants in each country.

We look forward to assisting your company in applying for a tax refund.

TABLE OF CONTENTS

From requirements definition to system development, configuration and CS

From requirements definition to system development, configuration and CS

- We define the requirements of our clients and propose services that match your As-Is and To-Be.

- We select from various tax engines as well as Avalara.

- When implementing the system, we will also develop the system if development is required. We will then implement the implementation and CS as well.

Tax engine implementation is also available

Tax engine implementation is also available

- The system also supports the installation of a tax engine into an ERP system, and when linked to MyOpti, it can handle everything from invoicing to tax calculations and e-Invoice support.

Also works with SAP S/4 Hana

Also works with SAP S/4 Hana

- We can also develop integration with SAP S/4Hana and Oracle Netsuite. Therefore, we can also handle integration with systems in large companies.

Other Services

We will identify and select the tax engine that best fits your business. We can also act as an RFQ agent.

We can also connect to your ERP system, etc. We have a development base in Vietnam, which enables us to develop your ERP system in the shortest time and at the lowest cost.

IT connectivity alone does not lead to actual tax registration and filing. We provide a one-stop service for tax registration, tax filing, and tax payment.