IOSS登録・IOSS申告

IOSS番号一つで、EU 27加盟国向けのビジネスは税務申告が可能です。詳しくは下記をご覧ください。

TOUCH

メリット

メリット

- 一つのVAT番号だけでEU27加盟国向けの越境ECビジネスに利用できます。

- IOSS番号を保持し、サイト上で記載させるだけでEU加盟国の消費者に安心感を与えることが出来ます。

- フォワーダーによる都度税額徴収と比較してコスト削減になります。

TOUCH

制約事項

制約事項

- IOSS申告は利用できる条件があります。

- 150ユーロ以下の商品が対象となります。

- 荷物の発送元は非EUである必要があります。

- 英国はEU加盟国ではないため、英国向けは別途英国VAT番号が必要となります。

TOUCH

ご利用企業

ご利用企業

- EU向け越境ECを検討している企業

- ShopifyやWooCommerce利用企業

- 150ユーロ以下の少額の物品を頻繁に販売する企業

Flow of IOSS Registration

IOSS登録までの流れ

IOSS登録までの流れは下記の通りです。

1

簡易分析

IOSSは150ユーロ以下の場合に限られます。このため、貴社がIOSS登録に向いているかどうかを確認します。

2

契約締結

IOSS登録・IOSS申告代行の契約を当社と貴社とで締結します。

3

必要書類提出

必要情報や必要書類などを貴社にご準備頂きます。準備が出来ましたら税番号登録申請書の提出を行います。

IOSS番号はEU向け電子商取引の最適な解決策

IOSSは越境EC販売に最適なVAT番号です。150ユーロ以下の物品であればIOSS番号での税申告が可能となります。通常のVAT番号では国毎にVAT番号を取得しなければならないところ、IOSSならEU27加盟国に利用できます。

Flow of IOSS Returns

IOSS申告の流れ

IOSS申告の流れは下記の通りです。

1

取引データ受領

貴社から取引データを受領します。

2

申告内容の承認

当社側で作成した申告内容を承認頂きます。

3

申告書提出

税務当局に申告書を提出します。なお、同時に、税額の支払いをお願いします。

MyOpti内で申告内容を確認頂けます。4

申告書保管

当社にて税申告書を保管します。

保管期間は契約により異なります。TABLE OF CONTENTS

loading...

TOUCH

アドバイスから申告・納税まで

アドバイスから申告・納税まで

- 当社では意見書の作成から税申告まで一括して対応します。

- 該当する税法や判例の他、最新の電子インボイス税制などのアドバイスも可能です。

- 間違えた地域での税登録を防ぎます。

- 意見書の結果に基づいて税登録や税申告も実施、納税対応も行っています。

TOUCH

70カ国以上の対象地域

70カ国以上の対象地域

- 当社ではEU、英国、UAE、ロシア、北米、カナダ、韓国、中国、インドなど、世界70カ国での税登録や税申告を対応可能です。

- またアドバイザリーではグローバルな世界最大級の税理士法人と提携し、世界140カ国以上の地域でのアドバイスが可能です。

- 一括して貴社ビジネスをご支援させて頂きます。

TOUCH

越境ECに関する知見とIT化

越境ECに関する知見とIT化

- 越境ECという言葉が黎明期であった13年前より当該分野ばかりを対応。

- 税務だけでなく関連する越境ECの情報も多くございます。また、越境EC周辺企業とも提供して価値を創造しています。

- 越境ECの税申告に特化したMyOptiをご利用頂き、一貫した対応が可能です。

Our Services

当社のサービス

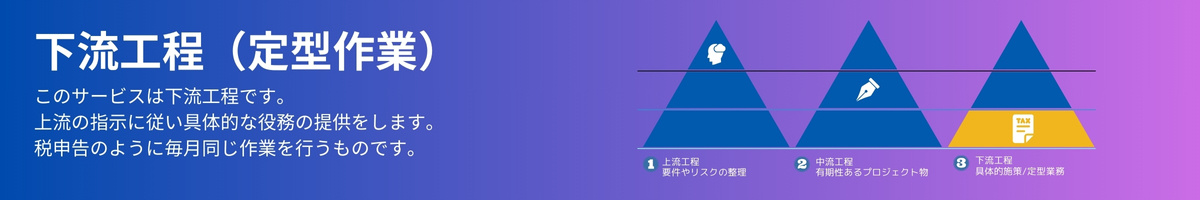

当社では上流工程から下流工程まで様々なご支援が可能です。