Sales Tax Registration and Sales Tax Returns

Sales and Use Tax is a type of state tax in the United States and is an indirect tax similar to sales tax. We can perform these sales tax registrations and sales tax returns for you.

TOUCH

Advantages

Advantages

- If you meet the U.S. state sales tax requirements (nexus), you are obligated to file a state sales tax return.

- State sales tax reporting can be handled for sales throughout the U.S.

- We use a tax filing tool that works with Amazon and Shopify, allowing for seamless filing.

TOUCH

constraint

constraint

- As a state tax, sales tax returns in numerous states are required once the tax registration requirement in each state is triggered.

TOUCH

Companies using our services

Companies using our services

- COMPANIES CONSIDERING CROSS-BORDER EC FOR THE U.S.

- Companies using Shopify and WooCommerce

- COMPANIES THAT WANT TO BUY AND SELL IN THE U.S. ON A B2B BASIS

- Companies wishing to sell digitally

Flow of Sales Tax Registration

Steps to Sales Tax Registration

The process for sales tax registration is as follows

1

Simplified Analysis

Check to see if your company qualifies for sales tax registration.

2

conclusion of a contract

We will enter into a contract with your company for sales tax registration and sales tax filing services.

3

Submission of Required Documents

Your company will prepare the necessary information and required documents. When you are ready, we will submit an application for tax ID number registration.

Sales tax numbers are the best solution for transactions to the U.S.

Possession of a sales tax number will allow you to sell locally. Conversely, non-U.S. companies are also required to file these taxes.

Flow of Sales Tax Returns

Sales Tax Filing Process

The sales tax filing process is as follows

1

Receipt of transaction data

We receive transaction data from your company.

2

Approval of declaration details

You are required to approve the contents of the declaration prepared by our company.

3

filing of a tax return

Submit the tax return to the tax authorities. At the same time, please pay the tax amount.

You can check your declaration in MyOpti.4

Retention of tax returns

We will keep your tax return on file with us.

Storage periods vary depending on the contract.TABLE OF CONTENTS

loading...

TOUCH

From advice to filing and tax payment

From advice to filing and tax payment

- We offer a full range of services, from preparation of opinion letters to tax returns.

- In addition to applicable tax laws and case law, we can also provide advice on the latest electronic invoice taxation system.

- Prevents tax registration in the wrong area.

- Based on the results of the opinion letter, tax registration and tax returns are also conducted and tax payments are handled.

TOUCH

More than 70 countries covered

More than 70 countries covered

- WE CAN HANDLE TAX REGISTRATIONS AND TAX RETURNS IN 70 COUNTRIES WORLDWIDE, INCLUDING THE EU, UK, UAE, RUSSIA, NORTH AMERICA, CANADA, KOREA, CHINA, AND INDIA.

- In addition, Advisory has partnered with one of the largest global tax firms in the world and can advise in more than 140 countries worldwide.

- We will support your business as a whole.

TOUCH

KNOWLEDGE OF CROSS-BORDER EC AND IT

KNOWLEDGE OF CROSS-BORDER EC AND IT

- WE HAVE BEEN DEALING EXCLUSIVELY WITH THIS FIELD SINCE 13 YEARS AGO, WHEN THE TERM "CROSS-BORDER EC" WAS IN ITS INFANCY.

- WE HAVE A LOT OF INFORMATION ON TAX AS WELL AS RELATED CROSS-BORDER EC. WE ALSO PROVIDE AND CREATE VALUE WITH COMPANIES AROUND CROSS-BORDER EC.

- You can use MyOpti, which specializes in cross-border EC tax reporting, for consistent service.

Our Services

Our Services

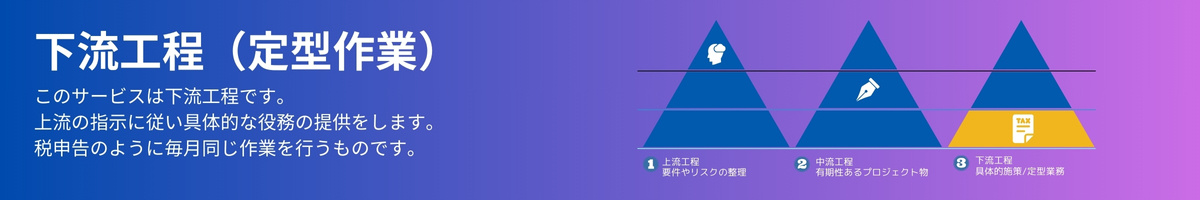

当社では上流工程から下流工程まで様々なご支援が可能です。