The company's inventory in Germany is to be moved to the company's factory in the Czech Republic.

Selling German company property to French companies.

∙ Selling products to European consumers through Amazon'sFBA warehouse.

∙ Selling goods from a warehouse in Japan to consumers in the UK on DDP terms.

The company will not be able to sell the products to the customers in Spain.

Selling digital services, such as apps, to individuals in the EU or in the UK

To act as a platform for the sale of goods to consumers in the EU.

Selling goods and services to consumers in the UK and EU through the company's website.

(*Actual individual examples of transactions should be reviewed)

Those in charge who easily thought that their company was only involved in the commercial flow should inform their suppliers and sellers in advance, because if the above taxable activities were to occur, local VAT registration would be required. In addition, if a VAT liability is incurred, a local VAT ofabout 20-27% must be imposed.

The taxable activities introduced above include digital business and cross-border e-commerce business, which can be participated in even without capital. Therefore, knowledge of such international indirect taxes is an issue that should be considered not only by listed companies but also by any company doing business globally.

Global taxation is for global tax professionals.

As indicated above, in Europe and elsewhere in the world, you can easily reach the local taxable act and thus be obligated to file a local tax return.

On the other hand, domestic tax accountants had no knowledge of overseas taxation and could not give advice to their clients because they explained the Japanese tax system. In addition, their advice was based on the Japanese tax system. As a result, activities that would normally be subject to local taxation and require local tax reporting were overlooked.

In this context, we have provided numerous advisory services on international indirect taxes ( VAT, Sales Tax, GST ).

International tax advisory is expensive.

On the other hand, if you seek advice from an international tax professional, he or she may charge you more than 1 million yen, some of which may amount to tens of millions of yen.

Since it is very difficult for small and medium-sized enterprises to raise these costs, it has not been easy to conduct a tax analysis, even though the need for a preliminary tax study was felt.

Even for a publicly traded company, it was not easy to raise such expenses.

In addition to this, it was difficult for small and medium-sized companies to have their own international tax specialists to coordinate such matters. Due to this lack of human and financial resources, there were many cases where local taxation activities that should have been investigated were not.

Cloud-based taxation analysis tool for a fixed annual fee

In the world, there was a company that provides such taxation analysis in the cloud. That is the VATCalc cloud tool introduced here.

OPTi Corporation has been persistently negotiating with Japanese businesses to introduce them to VATCalc, a tool that allows Japanese companies to easily perform tax analysis in the cloud, and has now been granted exclusive representation in Japan. Opti today signed a joint venture with UK-based VATCalc to provide groundbreaking global VAT and GST technology that will help Japanese businesses successfully trade globally without the risk of goods delays and tax fines at the border.

VATCalc VATCalc allows you to check in advance whether your company's transactions in the EU and the UK are taxable or non-taxable. The software also has an invoice creation function that allows you to create invoices in accordance with European VAT law. This eliminates the need to pay expensive fees to international tax specialists such as major tax firms.

VATCalc Function

The VATCalc platform includes four products that provide low-cost VAT automation tools for companies of all sizes, avoiding the major disruption of traditional solutions.

Product Features

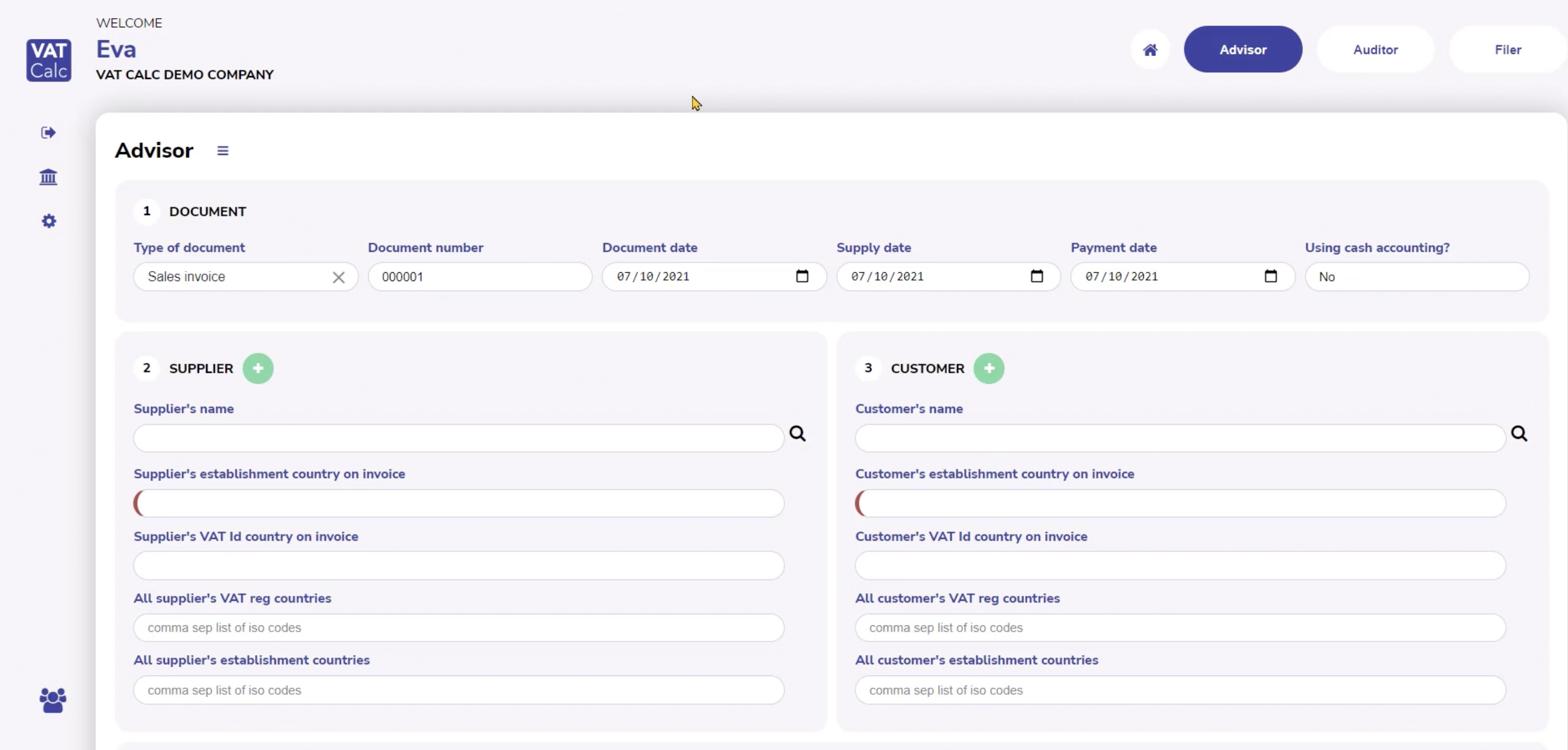

- VAT Advisor

- Easy-to-use online calculator for the most complex cross-border transactions. For every transaction, you can instantly see on-screen who is liable for VAT , the VAT that must be declared, any exempt or reverse charges, if VAT registration is required, statutory tax notices, and pro forma VAT invoices. This can be shared with suppliers, customers, or indeed client questions.

- VAT Auditor

- If you need to verify VAT on a batch of purchase invoices before claiming payment or deductions, simply upload them to Excel and Auditor will verify them instantly. This includes detailed errors and recommended changes to ensure that VAT is properly collected. The same applies to sales invoices. This means you always get your VAT right and avoid VAT declaration errors and fines.

- VAT Calculator

- Fully integrated tax engine for real-time VAT calculations on any transaction. It can connect to any accounting, ERP, billing, or marketplace platform to perform live invoice calculations. Thus, you can be assured that your sales invoices are correct every time and avoid over/undercharging your customers or bringing the attention of the tax authorities to them or to you.

- VAT FILER

- Once the VAT has been settled on each transaction, the filer can be used to create a draft of the tax return. Alternatively, this information can be used to create a PEPPOL standard electronic invoice.

Mr. Fuchigami commented as follows

At Opti, we are committed to helping our Japanese clients thrive when trading abroad." This new service brings them the best tax technology to help minimize tax friction, keep goods flowing, and assure their trading partners that VAT is being processed.

VATCalc Richard Asquith of VATCalc, Inc.

We are very excited to be partnering with Opti. VATCalc' s deep presence and trusted relationship with Japanese companies means that VATCalc' s cutting-edge technology is in the best position for the Japanese market. We look forward to them developing and building on their local base and continuing their global expansion .

If a tax audit reveals that a Japanese company has failed to correctly handle local indirect taxes (e.g., GST, sales tax, VAT, etc. ) and thereby failed to pay taxes, the company is at risk of additional tax collection. Furthermore, in addition to tax risks, a VAT number, a local tax identification number that takes several months to register, may be required to open an account.

OPTi provides a system that enables clients starting cross-border e-commerce, digital sales, and B2B sales to investigate international taxation relationships inexpensively by establishing a tax structure that complies with local rules and using IT tools and training functions for this purpose.

This allows even new tax staff with no knowledge of European VAT or UK VAT to issue invoices in line with the local tax system.

VATCalc We can also provide a free trial of VATCalc for business companies. Onboarding in Japanese is also available. Please contact us at 詳しくはaccount@opti.co.jpまでお問い合わせくださいませ. (Please do not contact us if you are in the same industry as us.)

About VATCalc

VATCalc helps companies of all sizes understand and automate VAT/GST when selling abroad.VATCalc's technology determines: in which countries VAT is due, its calculation, drafting invoices, creating the supporting legal tax citations, necessary VAT registrations, and drafting of foreign VAT returns.

CEO: Richard Asquith

Richard works with his team to foster and drive VATCalc's mission of digitizing VAT/GST and automating your tax headaches. We are proud to be a part of the VATCalc team. Prior to VATCalc, he played a key role in launching Avalara's VAT tech business and driving its illustrious growth. He joined the leadership team for the 2018 Avalara IPO. Prior to that, he founded vatlive.com, the world's largest free VAT/GST information website, which was acquired by Avalara in 2014. In 2005, Richard founded TMF Group's International VAT Compliance Services in 2004, which became the company's fastest growing division. Here he conceived and launched the first tax engine used by thousands of insurance companies worldwide. Richard trained with KPMG in the UK and subsequently worked with KPMG and EY in Hungary, Russia and France.

URL : https://www.vatcalc.com/

About Opti

Opti is a worldwide indirect tax filing agency with a focus on European VAT and US sales tax Opti is a tax advisory firm that provides tax advice on a variety of tax matters. The firm also provides various types of tax advice and has worked with over 1,000 companies in total. We have been filing VAT returns for cross-border EC since our founding in 2010, and have the most experience in this field in Japan. We are also familiar with the taxation systems of Shopify, WooCommerce, BASE, and STORES, and can provide tax advice that takes into account the actual conditions of cross-border EC. We also provide a lot of information on international taxation, and explain tax-related questions on the Payoneer website in the "Cross-border EC Tax Navigator" as a collection of Q&A. We also offer special plans for Visa business card holders.

As our management philosophy, our company motto is "to be a highway between Japan and the rest of the world," and as an internal rule, we aim to be "the best company in Japan where employees can grow and develop," pursuing job satisfaction and ease of work for our employees. OPTi is constantly researching the latest tools and developing in-house systems to simplify complex international taxation.

Representative: Satoru Fuchigami (President and CEO)

Established: November 11, 2010

Business: VAT registration and filing, sales tax registration and filing, tax consulting, VAT refund

Company website : https://www.opti.co.jp/tax

Cross-border EC Tax Navigator: https://www.opti. co.jp/ec-tax-navi

VATCalcの無料トライアルはaccount@opti.co.jpまでお問い合わせください.

(We regret to inform you that we do not accept inquiries from companies in the same industry.

▼ Inquiries from company representatives regarding indirect tax returns (VAT returns, sales tax returns, etc.):

E-mail: account@opti.co.jp

Contact: Yamazaki, Raku